IS YOUR COMPANY RECEIVING ALL OF THE L&I REFUND DUE?

On July 1, 1999 the Washington Aggregates and Concrete Association (WACA) launched their Group Retrospective Rating Program, also known as Retro. The WACA Retro Program was specifically designed with the members' interest in mind, not the Association's. It is a program where 100% of the refunds received are paid to the program members and not pocketed by the Association.

It's a program where all applicants are carefully screened to guard against assessment and maximize the group's refunds. It is a program where professional, aggressive and innovative claims management is applied to each and every claim. To date the program has earned over 6.1 million dollars in premium refunds representing a 31% return of premium. This program is open to all qualified members of our industry as well as other manufacturers.

For more information on the program and how it can benefit your company's bottom line and to determine if your company is eligible, please download, print, and return the temporary authorization for release of workers' compensation information form! Authorization for Release Form & WACA Retro Brochure.

HOW THE WACA RETRO PROGRAM WORKS

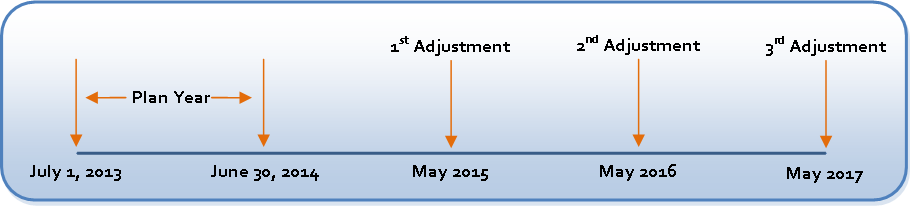

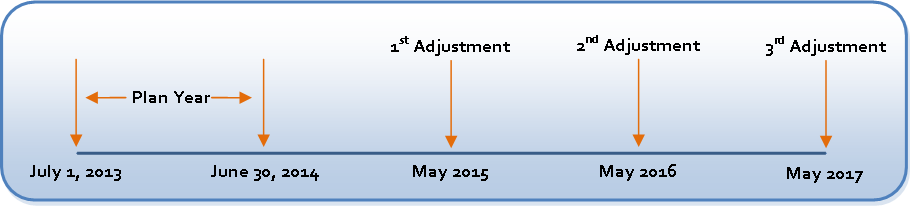

- L&I tracks the group members' premium and claims costs during a 12 month period of time known as a Plan Year

- L&I makes the 1st Adjustment Refund Calculation 10 months after the end of the Plan Year by subtracting the group members' actuarial adjusted claims from their retro premiums

- L&I makes the 2nd Adjustment Refund Calculation 22 months after the end of the Plan Year by subtracting the group members' actuarial adjusted claims from their retro premiums

- L&I makes the 3rd and Final Refund Calculation 34 months after the end of the Plan Year by subtracting the group members' actuarial adjusted claims from their retro premiums

WHAT ARE THE RISKS?

Retro is not without risk. If the group's actuarial adjusted claims exceed the group's retro premiums then the group members may be assessed additional premium, up to a predetermined amount. The WACA Retro program's assessment is limited to 32% of the members' plan year premium. The likelihood of assessment is low due to the historical loss history of the group; the steps that are taken to eliminate employers who have a history of high losses; and the efforts that are taken to control costs once a claim occurs. In addition, WACA has retained 10% of every refund to create a contingency reserve. This reserve will be used first in the event of an assessment prior to any member being assessed.

WHAT ARE THE PROGRAM FEES?

At the beginning of each quarter of the plan year in which the program member is eligible to earn a refund they are invoiced for 5% of their most recently reported quarterly premium payment to L&I. These fees cover the costs of program administration and claims management.

WHAT SERVICES DO WACA RETRO MEMBER RECIEVE?

Should your company have a claim, professional claims management services will be provided to your company by Employer Resources Northwest at no additional charge. They will work to return your injured employee to work as quickly as possible, thus keeping your and the group's claim costs low. Employer Resources Northwest will relieve your company of the "L&I claims hassle".

To maximize member refunds free safety training is provided statewide throughout the year. In addition, a Loss Prevention Loss Control Manager is available to program members for consultation at no additional cost. Finally, workers' comp legal representation for protests and appeals is provided at no cost through the settlement conference.

The services above will help you keep your employees safe while maximizing your refund.

WACA Retro plan design for the 2013-2014 plan year

- WACA's 2013-14 Retro Plan is a moderately conservative program capping all claims at a maximum cost of $120,000.

- Any assessment is limited to 32% of the members' plan year standard premium.

- 10 % of any refund is placed in the program's contingency reserve to be used in case of assessment.

- The balance of the refund is then distributed to program members based on individual company performance. The lower your claim costs, the greater the refund percentage you earn.

Retro participation does not change

- Who you send your premiums to (they still go to L&I);

- When you send your premiums to L&I;

- The per hour premium rate you pay L&I;

- The benefits your employees receive should they be injured on the job; or

- Your company's experience modification factor (premium rate multiplier).

CONTACT US

For immediate information on the program, or if you have questions, please contact John Meier at Employer Resources Northwest at (800) 433-7601 ext 827 or [email protected].

All information received from L&I will be held in confidence and you will receive a copy of all documents provided.